گزارش وضعیت سرمایه گذاری خطرپذیری شرکتی cvc در سال 2023

State of CVC 2023 Report

موسسه cb insight همجون سالهای قبل گزارش کاملی از وضعیت سرمایه گذاری خطرپذیر شرکتی در دنیا منتشر نموده است.

شرکت تکنو تجارت این گزارش را به فارسی ترجمه و نکات مهم آن را در قالب گزارشی منتشر کرده است.

فایل اصلی گزارش به همراه گزارشی فارسی آن در ادامه منتشر می شود.

State of CVC 2023 Report

CB Insights

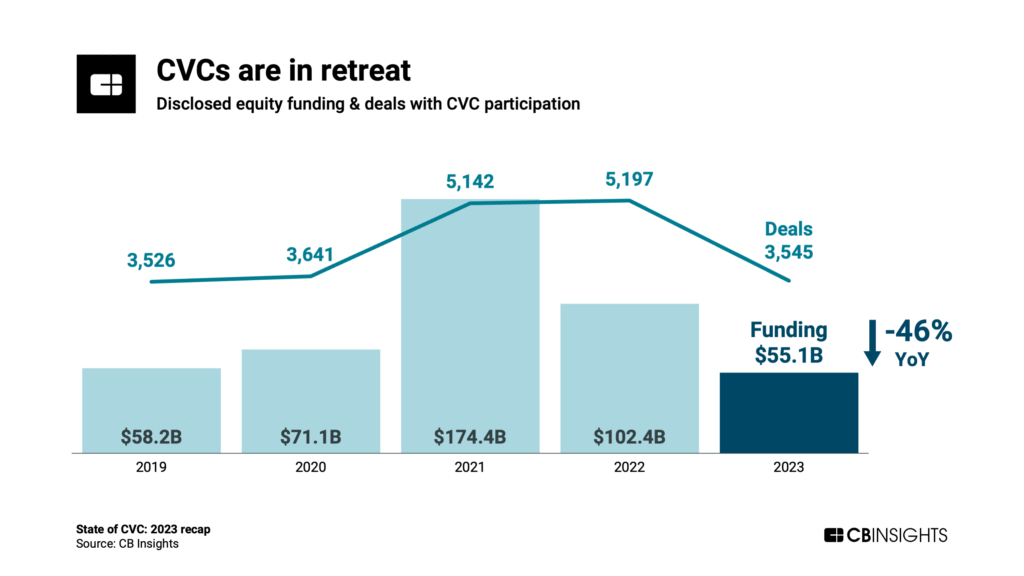

Corporate venture capital-backed deals and dollars fall to multi-year lows as CVCs shield themselves from the volatile tech market.

The corporate venture capital (CVC) market has constricted amid corporate belt-tightening and subdued returns from startup exits. In 2023, deals from CVCs fell to 3,545 — the lowest level since 2019 — marking a 32% drop YoY.

At the same time, fewer new CVCs are emerging: just 162 CVCs were founded in 2023 — a 6-year low.

Based on our deep dive below, here is the TLDR on the state of corporate venture:

- CVC activity is down significantly from 2021’s highs, with CVC-backed dollars and deals sinking to $55.1B across 3,545 deals in 2023. The decline in funding with CVC participation has been especially pronounced, while dealmaking, despite falling 32% YoY, remains above where it was in 2019.

- The US has been hit especially hard by the CVC retreat: Deal volume fell 25% QoQ to 233, a 6-year low, in Q4’23.This drove the US’ share of CVC deals down to just 29% among global regions — the lowest point in over a decade.

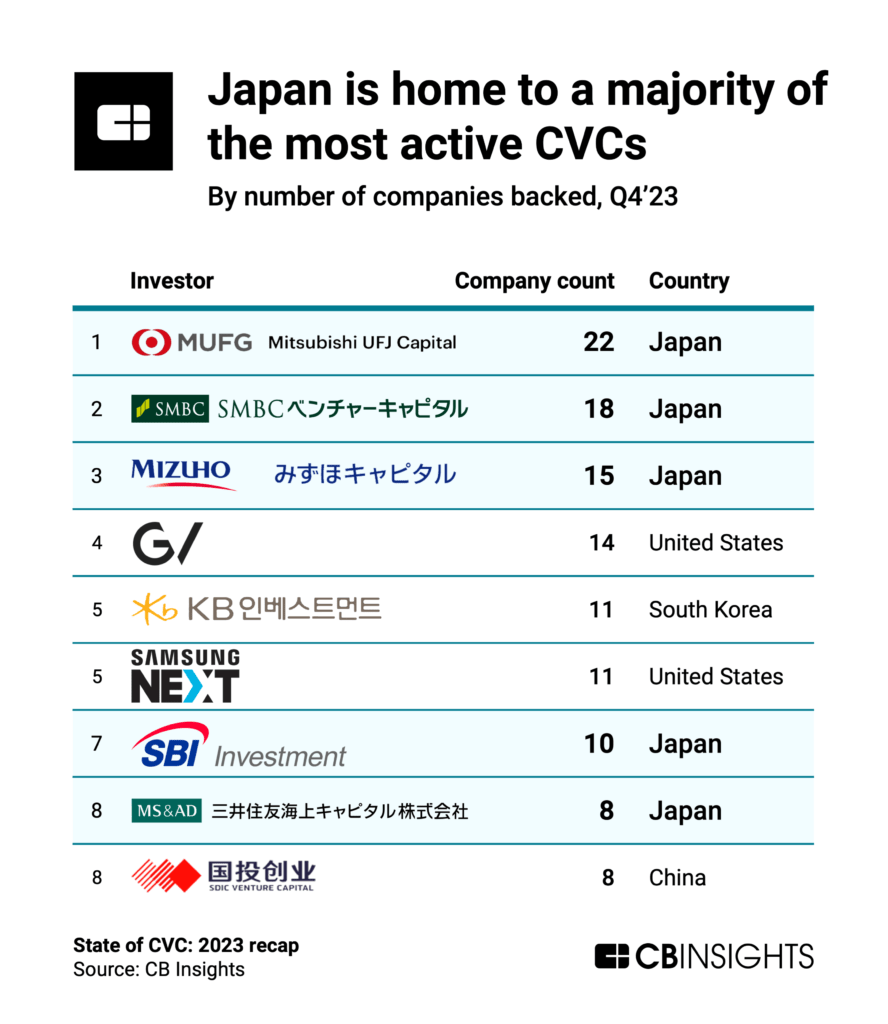

- A majority of the most active CVCs are based in Japan.The top 3 dealmakers in Q4’23 were all venture arms of Japanese financial services incumbents: Mitsubishi UFJ Capital (22 companies backed), SMBC Venture Capital (18), and Mizuho Capital (15).

- A generative AI company took the top CVC-backed deal in Q4’23.Aleph Alpha, a Germany-based LLM developer, raised a $500M round from investors including the venture arms of Bosch and Hubert Burda Media.

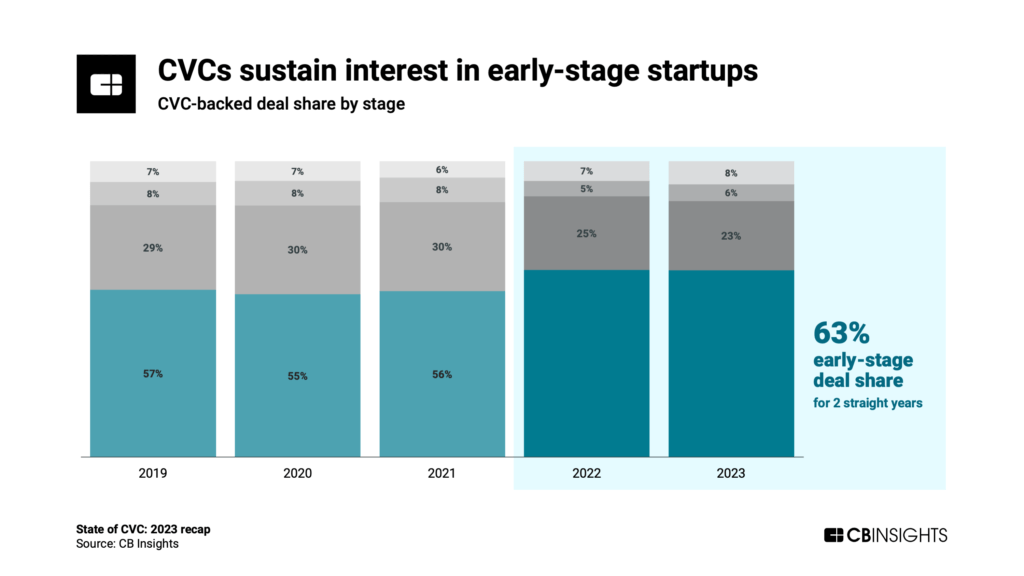

- Early-stage deal share has remained at an all-time high of 63% for 2 years running. CVCs are showing sustained interest in the earliest stages of startups, where they can form deep, long-term partnerships (and hopefully see greater financial returns in the long run).

دریافت فایل گزارش State of CVC 2023 Report : کلیک کنید

دریافت فایل ترجمه فارسی ( گزارش وضعیت سرمایه گذاری خطرپذیری شرکتی cvc در سال 2023) : کلیک کنید

دریافت فایل تکمیلی ترجمه فارسی ( گزارش وضعیت سرمایه گذاری خطرپذیری شرکتی cvc در سال 2023) : کلیک کنید